Send Money

Pay Your University Fees in easy steps

Experience seamless, secure, and compliant university fee payments globally—with one-time video KYC, App access, and transparent rates.

Why Choose J. B. Forex Pvt. Ltd. for University Fee Payments?

One-Time Video-KYC

Set KYC once and use it across multiple remittances—secure and hassle-free.

Choose from 180+ Universities

Select your university from our extensive list across the globe and pay in a few taps.

Transparent Pricing & Real-Time Rates

See live exchange rates and our fee before making the payment—no surprises, total clarity.

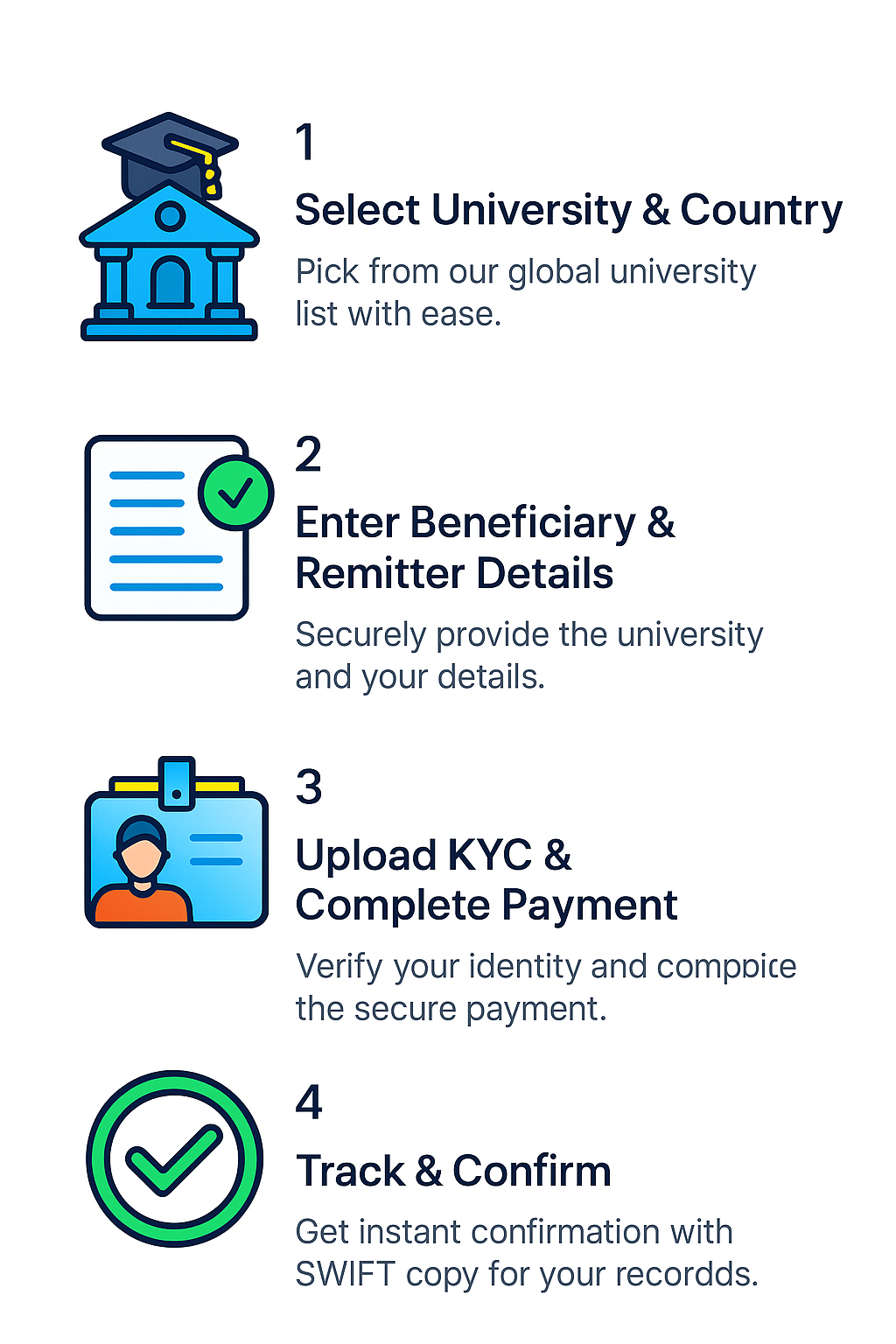

How It Works

-

1

Select University & Country

Pick from our global university list with ease.

-

2

Enter Beneficiary & Remitter Details

Securely provide the university and your details.

-

3

Upload KYC & Complete Payment

Verify your identity and complete the secure payment.

-

4

Track & Confirm

Get instant confirmation with SWIFT copy for your records.

Frequently Asked Questions

Find answers to common questions about forex trading and our services

Yes, it is advisable to carry a small value of your Forex in the form of currency notes so you have cash for immediate expenses like hiring cab, buying meal etc.

Travelers going to all countries other than (a), (b), and (c) below are allowed to purchase foreign currency notes / coins only up to USD 3000 per visit. Balance amount can be carried in the form of <a href="https://www.wsfx.in/wsfx-forex-cards" target="_blank" style="color:#222">store value cards</a>.<br><br>

Exceptions to this are:<br>

<ul>

<li>(a) Travelers proceeding to Iraq and Libya who can draw <a href="https://www.wsfx.in/outward-remittance" target="_blank" style="color:#222">foreign exchange</a> in the form of foreign currency notes and coins not exceeding USD 5000 or its equivalent per visit;</li>

<li>(b) Travelers proceeding to the Islamic Republic of Iran, Russian Federation and other Republics of Commonwealth of Independent States who can draw entire foreign exchange (up-to USD 250,000) in the form of foreign currency notes or coins.</li>

<li>(c) For travelers proceeding for Haj/Umar pilgrimage, full amount of entitlement (USD 250,000) in cash or up to the cash limit as specified by the Haj Committee of India, may be released by the ADs and FFMCs.</li>

</ul>

A resident Indian can take Indian rupees outside India (other than to Nepal, Bhutan, Pakistan and Bangladesh) as currency notes up to an amount not exceeding Rs. 25,000 per person.<br>

Any resident of India who has travelled to Pakistan and/or Bangladesh on a temporary visit, may bring into India at the time of his return, currency notes of Government of India and Reserve Bank of India notes up to an amount not exceeding Rs. 10,000 per person.

A person coming into India from abroad can bring with him foreign exchange without any limit. However, if the aggregate value of the foreign exchange in the form of currency notes, bank notes or travelers cheques brought in exceeds USD 10,000 or its equivalent and/or the value of foreign currency alone exceeds USD 5,000 or its equivalent, it should be declared to the Customs Authorities at the Airport in the Currency Declaration Form (CDF), on arrival in India.

Foreign exchange for travel abroad can be purchased from an authorized person against rupee payment in cash below Rs. 50,000/-. However, if the sale of foreign exchange is for the amount equivalent to Rs 50,000/- and above, the entire payment must be received only by a crossed cheque/RTGS/NEFT drawn on the applicant’s bank account.

On return from a foreign trip, travelers are required to surrender unspent foreign exchange held in the form of currency notes and travelers cheques within 180 days of return. However, they are free to retain foreign exchange up to USD 2,000, in the form of foreign currency notes or TCs for future use.

Form A2, application cum declaration, copies of a valid Passport, current address proof, confirmed return air ticket, Visa if available otherwise declaration on the same, and PAN card are required for buying foreign currency.

Permissible foreign exchange can be drawn 60 days in advance. In case it is not possible to use the foreign exchange within the period of 60 days, it should be immediately surrendered.